The ongoing COVID-19 pandemic has wreaked havoc on every aspect of human life, shattered global economies, and forced industries into bankruptcy. The insurance sector, owing to the nature of its workflow, finds itself among the worst-hit businesses. The usually busy insurance workplaces, buzzing with operational activities around the year, have been forced to either shut down their business or at least trim their workforce and operations owing to poor market conditions.

However, even though everything looks bleak and hopeless at present, it’s not all over for the insurance sector. In fact, smart insurers with a clear vision of the future and a roadmap in place to realize the goals have already started showing impressive signs of recovery. Industry leaders have very well realized that operations can’t continue in the traditional way and that substantial changes must be introduced to meet the demands of the post-COVID world. The sector has always acknowledged the need to outsource insurance back office services and has even reaped handsome profits by doing that. However, some insurers still had reservations when it came to trusting an external insurance back office support services provider due to unfounded reasons.

The COVID-19 pandemic has turned the tables and changed the equation insurance companies share with insurance back office service providers. It has underlined the fact that for any insurer to stay in the race in this competitive environment, maximizing operation efficiency by cutting out process bottlenecks is no longer an option but an absolute necessity. And to realize that in the face of intense market competition, outsourcing of insurance back office services to a truly capable and experienced service provider is the most prudent business move.

Critical Back Office Tasks That Insurers Should Outsource

Most insurance companies are aware of the need to work with an external partner but are in the dark about selecting the tasks or processes that should be outsourced. As a rule of thumb, insurers must always focus on just the major mission-critical activities that best connect them with their customers and enable them to serve their needs. All other tasks and activities must be handed over to the insurance back office support services provider to make operations effective and efficient. Of the plethora of back office tasks that are the perfect candidates for insurance back office process outsourcing, here’s a compilation of the top 6.

Data and Forms Processing Services

For insurance companies, data management is a worrisome and resource-hungry process that involves repetitive tasks like sourcing, sorting, storing, processing, and analyzing huge volumes of data. The high dependency on the human workforce has been a major pain point for the industry since businesses are forced to operate with skeleton staff during the pandemic. As most insurance providers are not equipped with the technology to automate data handling, the frequency of errors is skyrocketing while the efficiency is taking a hit.

A competent insurance back office support services firm possesses cutting-edge hardware and software for efficient data management. It can automate tedious tasks such as forms processing, document follow-ups, and document verification, and allow the client’s staff to work on the more productive activities of insurance selling. It can help the client convert historic data into digital format with efficient storage and retrieval. The lack of an adequate workforce in the current times can be compensated for by automating the data entry process for policy requests, renewal requests, and others. The back office partner can help the insurer with data mining services to provide it with a clear picture of the industry for making better decisions once the pandemic is over.

Insurance Commissions Management

As margins get tighter for the industry due to the economic crisis induced by the virus, having a transparent, automated, and error-free commission management system in place is critical to the survival of insurers. However, the operating costs for managing the complex commission system are getting exorbitantly high for the cash-strapped insurers. Also, a lack of uniformity in the commission amounts makes it difficult for the remotely-working in-house commission management team to manage the accounts accurately.

An experienced insurance back-office services provider can help the client streamline its commission setup with efficient handling of commission data, policy data, agent data, and client data. Such vendors use propriety commission software managed by insurance software experts to deliver quality commission services. They can support the client with dedicated commission agents and call center executives to ensure quick resolution of all commission-related queries.

Claims Management

Managing the huge inflow of insurance claims is one of the most intricate tasks in the insurance back office processes. Owing to the COVID-19 crisis, companies are witnessing a surge in claims and are struggling to contain the plummeting workforce productivity and the rising costs. Another trend witnessed during the ongoing pandemic is the rise in the instances of claims-related frauds and compliance failures. Having an error-free claims handling system is crucial for the sustenance of the insurer. Since claims management takes up substantial time and effort, most insurers prefer to delegate it to an insurance back office services expert. Such an insurance expert firm identifies and solves complex claims issues and assists its clients in settling all claims.

The insurance back office outsourcing partner helps insurers to manage the claims intake by verifying the authenticity of the claims and creating and tracking claims correspondence. Such reliable vendors are capable of manual and automatic claims allocation and can track payments to the claimants and service providers. In the current situation, insurers must retain their existing customers as getting new business is difficult, and hence delivering quality customer experience is the key. The claims management service provider helps insurers to this end by elevating the customer experience to boost the chances of retention. An advanced outsourced insurance BPO services provider also helps its client with predictive models to save them from the risks of falling for fake claims.

Customer Support

The pandemic has forced more than half of the staff to work from home where there is no adequate infrastructure for services like insurance customer support. But the number of customer queries hasn’t fallen due to the crisis and insurers cannot have any lame excuse to compromise on the customer service front. Outsourcing insurance BPO customer support to a seasoned service provider solves the problem for the client. The service provider will support the client with professional insurance call center agents who can help them build long-term relationships with their customers.

The service provider can offer both inbound and outbound customer support including IRV services, helpdesk services, claims processes and payment collections, product sales, sales support, third-party verification, and many more. An experienced vendor has the right infrastructure and manpower to offer multichannel support that makes it easy for customers to connect with insurers. The vendor helps the insurer’s in-house team to maintain physical distancing while delivering customer support through channels such as video calls, phone calls, chat, email support, etc.

Insurance Reporting

Even during unprecedented times like these, insurance companies must constantly meet regulatory requirements and reporting needs to handle daily operations and market uncertainties. Insurance reporting, amidst the ongoing chaos in the market, can cumbersome and a drain on the already stressed resources of the insurance companies. This is where insurance BPO service providers emerge as the savior, primarily for the small and mid-sized insurers. The insurance back office process outsourcing partner helps the client generate detailed insurance reports pertaining to insurance claims and enables it to adhere to all federal regulations to avoid legal troubles.

Besides claims reporting, the service provider helps the client track all its expenses through commission reporting, and transaction and policy renewal reporting services. Such specialists use the necessary software and procedures to generate time-consuming and complex reports in real-time by accessing the necessary data from the client’s system remotely. To ensure client satisfaction, the vendor ensures that the entire reporting process is completely transparent and error-free.

Accounting Services

With most insurance companies operating with less than half of their staff, the accounting department has taken a massive hit. Since accounting is a job of specialists and demands special tools for accurate results, work-from-home environments can never produce the same results as working from the office. This has impelled insurers around the world to cut down on their dependency on in-house accountants and seek external help.

Insurance back office service providers support their clients with expert accounting and bookkeeping professionals who would efficiently handle critical processes like account reconciliation, tax preparation, and other daily accounting needs. The vendor can set up new accounting software for the client tailored to their needs and train the client’s staff to use the same for optimum outcomes. To help realize regular cash flow, the vendor can help the client with follow-ups on outstanding invoices and reporting on account activities.

Read Also How Insurance Companies can make their Operations more Resilient in the Second Half of 2020

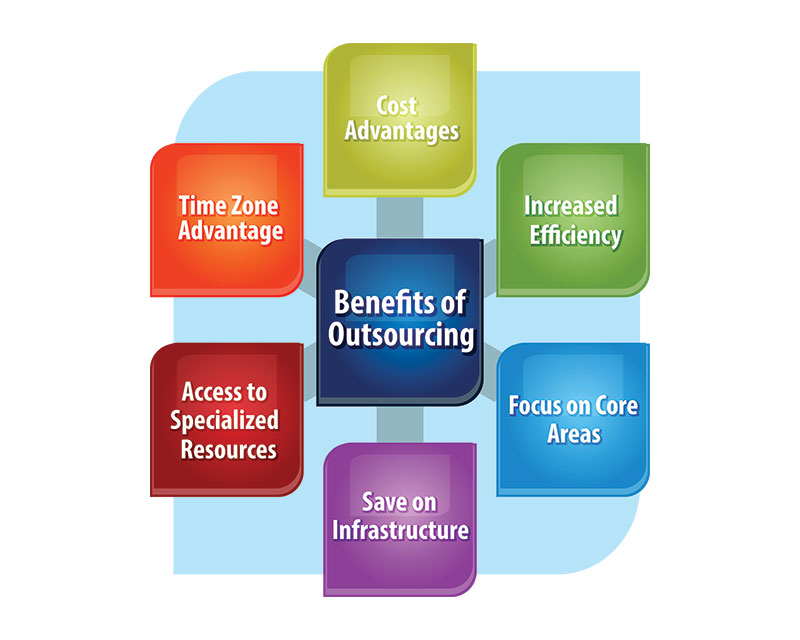

Benefits Outsourcing Insurance Back Office Tasks during COVID-19

Besides the aforementioned back office processes, there are several other critical functions that insurers around the world are delegating to external service providers to mitigate the threats posed by the pandemic. The industry leaders are quickly embracing the benefits of outsourcing daily operations while the core teams prepare to harness the opportunities in the post-COVID period. Here are a few of the compelling advantages of insurance back office outsourcing during the ongoing coronavirus pandemic.

Minimize health risks for staff and clients

Tasks such as property inspection and claims verification usually involve hours of investigation and analysis, and require physical contact with multiple stakeholders. At a time when operations are already suffering due to reduced manpower, it would be disastrous if the remaining employees also contract the virus. Outsourcing allows insurers to preserve their staff and allow them to maintain social distancing at the office while continuing operations with special software and technology provided by the vendor partner.

Time and cost optimization

As the virus has landed a severe blow to every major economy in the world, small insurers are desperately trying to stay afloat in the market. Cost-cutting is the only way out for them and thus, insurance back office outsourcing emerges as the logical choice. External outsourced insurance service providers deliver quality results at surprisingly low costs and also enable their clients to save time on processes such as property inspection and reporting. Also, the in-house team is relieved of the non-value-adding activities and now it can focus on new opportunities while improving the relationships with the existing clients.

Prepare for the future

The pandemic has underlined the need for insurers to adopt new technology to transform their existing business model with digitization. A well-equipped vendor can help its client automate the different insurance workflows so that it’s better prepared to handle any pandemic-like situation in the future. Also, using workflow modernization, the client can enhance its legacy systems and work on product innovations such as flexible premium and usage-based products for better customer experience. The vendor can help the client in creating strategies by taking into consideration their products, distribution channels, customer base, and others.

Although the COVID-19 crisis is being perceived as the worst thing to happen to the insurance sector, there’s a silver lining to it that brings new hopes for the industry. However, to cash in on those, industry players must work smart while delivering first-rate customer service. And outsourcing the tedious back office processes to a reliable service provider is a great way to align the insurance industry to the needs of the post-COVID world.

Who We Are and Why Our Expertise Matters?

This article is brought to you by Insurance Back Office Pro, an end-to-end insurance support service provider with over a decade of serving reputed clients in the industry. In these difficult times, we are helping our clients mitigate all business risks and keep operations running smoothly by adopting new practices. We use modern digital tools for remote collaboration with clients and support them with cutting-edge technology to ensure business continuity while preparing for a brighter future.